Introduction

One of the things I find most frustrating about technology forecasts and visions – especially in telecoms and mobile – is the lack of awareness of adjacent issues and trends, or consideration of "gotchas" and alternative scenarios.

One of the things I find most frustrating about technology forecasts and visions – especially in telecoms and mobile – is the lack of awareness of adjacent issues and trends, or consideration of "gotchas" and alternative scenarios.

So for example, when telcos, vendors or policymakers predict what 5G deployment, or network-slicing, or edge-computing or anything else might result in –

applications, uptake, revenue opportunities and so on – they often fail to ask

two critical questions:

- Distractions: What are the prerequisites for this to happen? What are the bits of the overall wider system that are forgotten but necessary, to make the headline technology feasible and useful? And when will they be achieved? What's the weakest link in the chain? Is delay inevitable?

- Disruptions: What else is likely to happen in the meantime, which could undermine the assumptions about demand, supply or value-chain structure? What's going on in adjacent or related sectors? What disruptions can be predicted?

This post has an accompanying podcast, on my SoundCloud:

Internal distractions & pre-requisites

So for example, for 5G to be successful to the degree that many predict (“trillions of $ of extra GDP”, millions of extra jobs etc) there first needs to be:

- Almost ubiquitous 5G coverage, especially indoors, in sparse rural areas, and in other challenging locations

- Enough fibre or other backhaul connectivity for the cell-sites

- Suitable software and hardware platforms to run the virtualised core and other elements

- Enough physical sites to put antennas, at low-enough costs & with easy-enough planning

- Many more engineers trained and qualified to do all of the above

- A decent business case, for instance in remote areas

- 3GPP release 16 & 17 to be completed, commercialised and deployed, especially for the ultra-low latency & high-reliability applications.

- Optimisation and operational systems, perhaps based on as-yet-unproven AI

Yet vendors and policymakers often gloss over these "annoying"

practicalities. There seems to be an attitude of “oh, they’ll have to make it

work somehow”. Well, yes, perhaps they will. But when? And at what cost? What changes does that imply? How will the gaps and limitations be bridged? And what happens if firms go bust while waiting for it all to happen? What other ways to solve problems can users pursue sooner, that don't involve 5G?

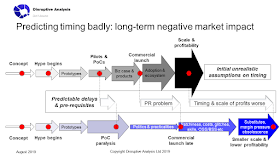

A key implication of this is that timing and profitability of massmarket adoption is often much later than expected. While Amara's Law might eventually apply (we tend to overestimate the effect of a technology in the short run and underestimate the effect in the long term), that doesn't mean that early initial adopters and investors make the returns they'd hoped for.

A key implication of this is that timing and profitability of massmarket adoption is often much later than expected. While Amara's Law might eventually apply (we tend to overestimate the effect of a technology in the short run and underestimate the effect in the long term), that doesn't mean that early initial adopters and investors make the returns they'd hoped for.

External disruptions and substitutes

Perhaps even more pernicious is the lack of situational awareness about parallel developments elsewhere in the broader tech ecosystem. These undermine both demand (as alternative solutions become viable in place of the hoped-for technology) and supply / operation (by throwing up new complexities and gotchas to deal with).

These are often not just “what ifs" but “highly likelies” or "dead-on certainties".

Perhaps even more pernicious is the lack of situational awareness about parallel developments elsewhere in the broader tech ecosystem. These undermine both demand (as alternative solutions become viable in place of the hoped-for technology) and supply / operation (by throwing up new complexities and gotchas to deal with).

These are often not just “what ifs" but “highly likelies” or "dead-on certainties".

So for instance, the visions of network slicing, or

edge-computing for 5G (which will really only crystallise into large-scale commercial

reality in maybe 4-5 years) will have to contend with a future world where:

- 5G networks are still patchy. There will still be lots of 4G, 3G and “no G” locations. What happens at the boundaries, and how can you sell QoS only in certain places?

- There will be a patchwork of “uncontrolled” locations – they might be 5G, but they could be owned by roaming partners, indoor network providers, private localised cellular operators and so on. How will a slice work on a neutral-host's network?

- An ever-greater number of devices spend an ever-greater amount of time on Wi-Fi – usually connected to someone else’s fixed-line infrastructure and acting as either uncontrolled, or a direct arbitrage path.

- Telcos have to cap their energy use and associated CO2 emissions, or source/generate clean power of their own.

- Wi-Fi 6 will emerge rapidly & is hugely improved for many use-cases, but most 5G predictions only compare against legacy versions

- Hardware based on "commodity hardware" runs against the current tide of semiconductor fragmentation and specialisation (see recent post, here)

- Devices will often have VPN connections, or use encryption and obfuscation techniques, which means the network won't be able to infer applications or control traffiic.

- Users and devices will use multiple connections together, either for arbitrage, aggregation, or more-sophisticated SD-WAN type models.

- Pricing, billing, customer support and security will be challenging on "federated" 5G or edge-compute networks. Who do you call when your network-slice doesn't deliver as expected - and how can they diagnose and fix the problem?

- Liability and accountability will become huge issues, especially if 5G or slicing is used for business-critical or life-critical functions. Are your lawyers and insurers prepared?

- AI will be used for instant price-comparison, quality monitoring & fault reporting, collective purchasing and even contractual negotiations. "Hey, Siri, mimic my voice and get me the best discount possible with the customer-retention agents"

Conclusions

I find this all very frustrating. So many company boards, strategy departments or lower-level product/service management teams seem to operate on the basis of "all other things being equal..." when the one certainty is that they won't be.

So the two sets of factors tend to be multiplicative:

- Distractions are internal to a new concept, and lead to delays in technology launch, market maturity and revenue.

- Disruptions are external and often inevitable, but any extra delay increases their range and impact yet further.

Companies accept the "hype cycle" as inevitable, even if it might be possible to flatten it out.

By coincidence, while writing this post I started reading "Range" by David Epstein (link) which talks about the importance of "analogising widely", and the risks of narrow expertise and superficial analysis, rather than looking for implications of cross-sector / cross-discipline similarities and lessons.

When evaluating new technologies and service concepts, CEOs and CFOs need to rely less on familiar industry echo-chambers and consensus hype, and instead seek out critics who can find hidden assumptions, both internal and external to their plans. This isn't just a negative exercise either - often, a "ranging" exercise throws up unexpected positives and opportunities from adjacency as well risks.

This post has an accompanying audio podcast - click here & please subscribe!

Footnote

I sometimes get asked to "stress test" ideas and plans, and help companies avoid expensive mistakes, get started on future glitches today, or prepare for and avoid contingencies and unintended consequences.

Often, that exercise will throw up new opportunities as well. Usually, a collaborative (but candid) group workshop ensures this isn't a blame-game, but a path to smoother growth and innovation. The skills and mindsets can be learned and replicated, too.

If that type of approach sounds interesting, please get in touch with me, either by email (information AT disruptive-analysis DOT com) or via LinkedIn (link).