I've now completed & published the updated 2014 version of the Disruptive Analysis WebRTC Industry Status & Forecasts Report. I believe that it is the most detailed research-company study on WebRTC available, based on ongoing primary research, extensive quantitative market modelling and a thorough investigation of as many use-cases as possible.

- WebRTC “Democratises” realtime comms from specialists to a broader developer base

- Use cases in many sectors: telecoms, consumer web, enterprise comms, M2M etc

- One of the most disruptive & important web/telecoms innovations for 10 years

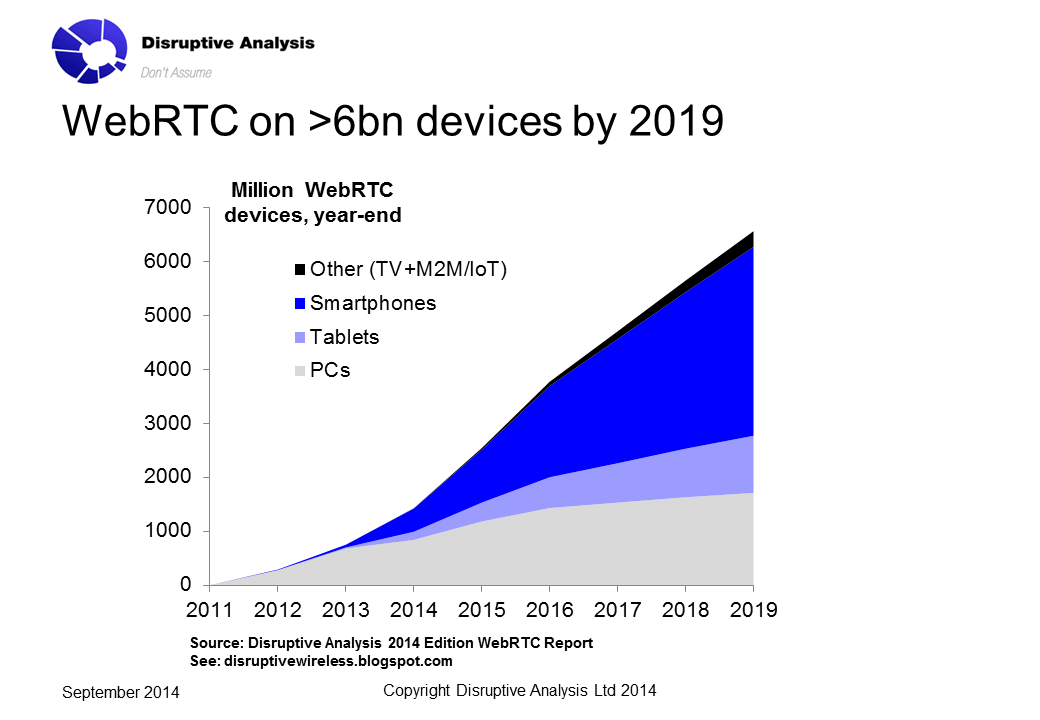

- 6+ billion capable devices, and c2 billion individual users of WebRTC by end-2019

- Evolving from original browser-based standard to richer “comms philosophy”

- Smartphone & tablet capability for WebRTC starting to ramp up strongly

- Pivotal role for new tier of cloud platform / API players. Also open-source critical

- Microsoft involvement in new ORTC standard a good sign. Apple still MIA

- “Headline acts” like Amazon, Amex, Snapchat, Google catalysing wider interest

- Early use-cases for customer care, web calling, conferencing & some verticals

- Enterprise will see WebRTC in both unified and “dis-unified” comms contexts

- Telcos/SPs getting more serious. 10+ service launches, but IMS integration slow

- Magnifies the “OTT” threat for telcos, but also eases Telco-OTT innovation

- Numerous “gateway” sub-types for vendors to target, but moving to XaaS models

- Monetisation of WebRTC will be heavily use-case dependent

- Still some impatience with pace of development – but a lot happening below surface

- As in 2013, Disruptive Analysis believes the hype is still justified

To order, see base of this page

To give some background - I've been watching WebRTC since its inception in mid-2011. I've advised numerous market participants on WebRTC specifically, and the broader Future of Voice/Video for a long time prior to its arrival; I'm also a regular figure at industry conferences & webinars covering the technology in Europe, North America and Asia. I was recently annointed as a "WebRTC Pioneer" by the guys at TMC (thanks!)

The first edition of the report, published in February 2013, set the standard for forecasts, with data ("4bn devices by 2016") used almost ubiquitously across the industry.

Since then, much has changed. 2013 and 2014 have seen huge evolution. In particular, it has evolved from a “purist” web- and browser-centric standard, to one that has broadened to integrate with established communications systems, as well as being embedded directly into mobile apps and M2M devices. While its deployment varies in pace by sector, it is now applicable to so many different areas and use-cases that delay in any one context cannot derail the overall proposition.

Looking towards 2015, Disruptive Analysis sees the picture

evolving again. WebRTC-based capabilities will crop up in day-to-day websites,

as well as dedicated platforms for businesses or telecom verticals. New formats

will also emerge, including integration with cable set-top boxes for

interactive TV-based usage, or various other M2M and data-connectivity

variants.

The all-new 190-page report extends it the original analysis considerably. It covers all the key WebRTC use-cases & companies within:

- Enterprise communications

- Telecom service providers & cable

- Consumer web & mobile apps

- M2M &IoT

- Cloud platforms & APIs

The report contains the most detailed & comprehensive forecasts on WebRTC adoption available from any analyst firm:

- WebRTC-capable device numbers, by PC/phone/tablet/M2M & geographic region

- Consumer WebRTC users for standalone & embedded voice/video

- Business WebRTC users for contact centres, UC and app-embedded communications

- Telco WebRTC users for VoIP/VoLTE extension, Telco-OTT services & cable/IPTV

- M2M/IoT estimates for WebRTC integration

The report has detailed qualitative analysis & many examples of use-cases, live deployed services and lists of vendors in all the key areas. It covers the critical strategic issues facing WebRTC (standards, browser support, business models, regulation etc) and provides actionable recommendations for the main stakeholder groups. It also has full background information on market drivers such as telcos vs. OTT, enterprise BYOx trends, and the emergence of WebRTC cloud and platform providers.

The report is 190 pages in length and contains over 100 charts, tables and graphics.

It is available either as a one-off report, or as a subscription with two interim updates of c25 pages length, scheduled for publication in Dec/Jan and Apr/May timeframes.

Pricing of the report is as follows:

- 1-3 user licence: US$1700 for main report, $2500 with 2x interim updates

- Corporate licence: US$2500 for main report, $3700 with 2x interim updates

Please also get in touch if you are interested in internal workshops, custom advisory projects or speaking engagements about WebRTC.

CONTENTS

Executive Summary and Recommendations

Strategic issues

What has changed since 2013?

What has changed since 2013?

Use cases & market segment

Platforms & cloud APIs

Platforms & cloud APIs

Enterprise

Telecoms operators

Consumer web & apps

M2M & IoT

Device support forecasts

WebRTC adoption forecasts

Enterprise/Telecom/Consumer

WebRTC industry timeline 2014-2019

Companies & vendors

Recommendations

For web & app developers

For telecom operators

For enterprise IT & telecom end-users & suppliers

For network vendors & cloud platforms

For VoIP, video & messaging providers

For industry bodies & regulators

For investors & consultants

Strategic Issues for WebRTC in 2014/15

Strategic Issues for WebRTC in 2014/15

What is WebRTC & why is it important?

WebRTC standards evolution

Roles of IETF, W3C & others

ORTC

Mainstream developer awareness & adoption

The battle for the soul of WebRTC: Beyond the Browser

Value-chain Richness & “The WebRTC Ecosystem”

The Emergence of Mobile WebRTC

Participation of key players

Apple & WebRTC

Microsoft, WebRTC and ORTC

Where are the OTTs?

The battle for the soul of WebRTC: Beyond the Browser

Value-chain Richness & “The WebRTC Ecosystem”

The Emergence of Mobile WebRTC

Participation of key players

Apple & WebRTC

Microsoft, WebRTC and ORTC

Where are the OTTs?

Usability and interaction design

The mix of WebRTC voice, video and data

Regulatory considerations

Evolving attitudes to interoperability

Regional differences within WebRTC

The mix of WebRTC voice, video and data

Regulatory considerations

Evolving attitudes to interoperability

Regional differences within WebRTC

New monetisation and business models

WebRTC Device Support Forecasts

Introduction

PC support of WebRTC

Smartphone support of WebRTC

Tablet support of WebRTC

TV & M2M/IoT support of WebRTC

Summary

Introduction

PC support of WebRTC

Smartphone support of WebRTC

Tablet support of WebRTC

TV & M2M/IoT support of WebRTC

Summary

WebRTC Platforms, Gateways, Tools & APIs

Introduction

What is needed to develop and launch a WebRTC service?

Market categorisation & vendor/PaaS fragmentation

Platform use-cases & differentiating dimensions

What to develop in-house, what to outsource?

Platform/API providers: industry dynamics

WebRTC Platforms/APIs conclusions & predictions

Overview

Solutions-oriented platforms

Distribution channels for WebRTC platforms & APIs

WebRTC platform interoperability?

WebRTC & Enterprise Communications

WebRTC for business: The Big Picture

The strategic “Great Game”

Introduction to WebRTC in enterprise

Beyond UC: The emergence of enterprise WebRTC frameworks

Background: General trends in enterprise communications

CEBP revisited

Contact centres & customer support / interaction

Contact centres & customer interaction: Key background issues and trends

Customer interaction: WebRTC use-cases, roles and adoption drivers

Amazon Mayday as a Catalyst

Growth of multi-channel & web live-chat

Customer interaction: WebRTC deployment

Contact centre outsourcing

Customer interaction: WebRTC vendor strategies

B2B Conferencing

Conferencing: Key background issues and trends

Conferencing: WebRTC use-cases, roles and adoption drivers

Conferencing: WebRTC challenges and limitations

Conferencing: WebRTC vendor strategies

Unified communications, IP-PBXs & collaboration

Overview

UC defined: Key background issues and trends

UC: WebRTC use-cases, roles and adoption drivers

UC: WebRTC challenges and limitations

UC: WebRTC vendor strategies

Application-embedded WebRTC

Enterprise WebRTC adoption & forecasts

Overview

Business demographics

Adoption of WebRTC in UC, collaboration & business apps

Contact centre adoption of WebRTC

Sensitivities

WebRTC & Telecom Service Providers

Introduction & overview

Key background trends for telcos & SPs

Ubiquitous broadband driving all-IP communications: 4G, 5G, fibre, cable

Service innovation, strategic direction & telco organisation

Network-based services innovation vs. Non-network

The “OTT model”: Decoupling access from service

Network & OSS evolution: NFV & SDN

“Peak Telephony” and the importance of “intent” for communications

Fragmentation of communications – is “disunified comms” the real trend?

Telcos’ current involvement with WebRTC

Overview of WebRTC service segments & business models

Telco network & IMS/VoLTE/RCS extension

The extension strategy

WebRTC & VoIP/VoLTE extension

Developer IMS/WebRTC APIs

WebRTC standards evolution for telcos

WebRTC to extend RCS / joyn

TV & cable integration of WebRTC

Non-mainstream communications service providers

Non-integrated Telco WebRTC

Build vs. buy vs. resell vs. acquire etc.

Massmarket telco-OTT VoIP & video-call services

WebRTC + telco developer / API initiatives

Enterprise & cloud

Digital Home services

Internal uses for WebRTC at telcos

Investment, incubation etc

Carrier-focused vendor landscape

Telecom WebRTC adoption & forecasts

VoIP/VoLTE+WebRTC forecasts

Telco-OTT VoIP/video WebRTC forecasts

Cable/IPTV WebRTC forecasts

Summary

WebRTC & Consumer Web & Apps

General drivers and inhibitors for consumer WebRTC

Mobile WebRTC Apps

Video Chat & General Communications

Social Networking & Messaging

Games, Entertainment, Music & Media

Personal Productivity, Tuition & Online Life

Dating & Adult

Advertising

Consumer WebRTC adoption & forecasts

Standalone consumer WebRTC VoIP/video forecasts

Embedded consumer WebRTC forecasts

WebRTC, Data, IoT & Emerging Use-Cases

DataChannel evolution

M2M / IoT

Emergency Communications & Public Safety

Forecasts for M2M/IOT & WebRTC

About Disruptive Analysis

ORDERING

Payment can be made by credit card or Paypal below - report will typically be delivered via email within 24 hours. Please select:

Introduction

What is needed to develop and launch a WebRTC service?

Market categorisation & vendor/PaaS fragmentation

Platform use-cases & differentiating dimensions

What to develop in-house, what to outsource?

Platform/API providers: industry dynamics

WebRTC Platforms/APIs conclusions & predictions

Overview

Solutions-oriented platforms

Distribution channels for WebRTC platforms & APIs

WebRTC platform interoperability?

WebRTC & Enterprise Communications

WebRTC for business: The Big Picture

The strategic “Great Game”

Introduction to WebRTC in enterprise

Beyond UC: The emergence of enterprise WebRTC frameworks

Background: General trends in enterprise communications

CEBP revisited

Contact centres & customer support / interaction

Contact centres & customer interaction: Key background issues and trends

Customer interaction: WebRTC use-cases, roles and adoption drivers

Amazon Mayday as a Catalyst

Growth of multi-channel & web live-chat

Customer interaction: WebRTC deployment

Contact centre outsourcing

Customer interaction: WebRTC vendor strategies

B2B Conferencing

Conferencing: Key background issues and trends

Conferencing: WebRTC use-cases, roles and adoption drivers

Conferencing: WebRTC challenges and limitations

Conferencing: WebRTC vendor strategies

Unified communications, IP-PBXs & collaboration

Overview

UC defined: Key background issues and trends

UC: WebRTC use-cases, roles and adoption drivers

UC: WebRTC challenges and limitations

UC: WebRTC vendor strategies

Application-embedded WebRTC

Enterprise WebRTC adoption & forecasts

Overview

Business demographics

Adoption of WebRTC in UC, collaboration & business apps

Contact centre adoption of WebRTC

Sensitivities

WebRTC & Telecom Service Providers

Introduction & overview

Key background trends for telcos & SPs

Ubiquitous broadband driving all-IP communications: 4G, 5G, fibre, cable

Service innovation, strategic direction & telco organisation

Network-based services innovation vs. Non-network

The “OTT model”: Decoupling access from service

Network & OSS evolution: NFV & SDN

“Peak Telephony” and the importance of “intent” for communications

Fragmentation of communications – is “disunified comms” the real trend?

Telcos’ current involvement with WebRTC

Overview of WebRTC service segments & business models

Telco network & IMS/VoLTE/RCS extension

The extension strategy

WebRTC & VoIP/VoLTE extension

Developer IMS/WebRTC APIs

WebRTC standards evolution for telcos

WebRTC to extend RCS / joyn

TV & cable integration of WebRTC

Non-mainstream communications service providers

Non-integrated Telco WebRTC

Build vs. buy vs. resell vs. acquire etc.

Massmarket telco-OTT VoIP & video-call services

WebRTC + telco developer / API initiatives

Enterprise & cloud

Digital Home services

Internal uses for WebRTC at telcos

Investment, incubation etc

Carrier-focused vendor landscape

Telecom WebRTC adoption & forecasts

VoIP/VoLTE+WebRTC forecasts

Telco-OTT VoIP/video WebRTC forecasts

Cable/IPTV WebRTC forecasts

Summary

WebRTC & Consumer Web & Apps

General drivers and inhibitors for consumer WebRTC

Mobile WebRTC Apps

Video Chat & General Communications

Social Networking & Messaging

Games, Entertainment, Music & Media

Personal Productivity, Tuition & Online Life

Dating & Adult

Advertising

Consumer WebRTC adoption & forecasts

Standalone consumer WebRTC VoIP/video forecasts

Embedded consumer WebRTC forecasts

WebRTC, Data, IoT & Emerging Use-Cases

DataChannel evolution

M2M / IoT

Emergency Communications & Public Safety

Forecasts for M2M/IOT & WebRTC

About Disruptive Analysis

ORDERING

Payment can be made by credit card or Paypal below - report will typically be delivered via email within 24 hours. Please select:

- 1-3 users vs. corporate licence

- One-off report vs. inclusion of 2x interim updates

- VAT details / payment for UK/EU purchases

No comments:

Post a Comment