This blog combines two separate, linked LinkedIn articles published in June 2023 on consecutive days. The original posts and comment threads are here and here.

Measuring #mobile data traffic is important for operators, vendors, and policymakers.

As I've said before, we should use *good* #metrics to measure the #telecoms industry, rather than just *easy* metrics. This post is an example of what I mean.

Yesterday, Ericsson

released its latest Mobility Report. It's always an interesting trove

of statistics on mobile subscribers, networks and usage, with extra

topical articles, sometimes written by customers or guests.

While

obviously it's very oriented to cellular technologies and has an

optimistic pro-3GPP stance, it has a long pedigree and a lot of work

goes into it. It's partly informed by private stats from Ericsson's

real-world, in-service networks run by MNO customers.

This edition includes extra detail, such as breaking out fixed-wireless access & separating video traffic into VoD #streaming (eg Netflix) vs. social media like TikTok and YouTube.

It

had plenty of golden "information nuggets". For instance, traffic

density can be 500-1000x higher in dense urban locations than sparse

rural areas. I'll come back to that another time.

Global mobile

data grew 36% from Q1'22 to Q1'23. The full model online predicts 31%

growth in CY2023, falling to just 15% in 2028, despite adding in AR/VR

applications towards the end of the decade. That's a fairly rapid

s-curve flattening.

For Europe, MBB data growth is predicted at

29% in 2023, falling to only 12% in 2028. That's a *really* important

one for all sorts of reasons, and is considerably lower than many other

forecasts.

But what really caught my eye was this "#FWA

data traffic represented 21% of global mobile data traffic at the end

of 2022". Further, it is projected to grow much faster than mobile

broadband (MBB) and account for *30%* of total traffic in 2028, mostly #5G. When the famous "5G triangle" of use-cases was developed by ITU, it didn't even mention FWA.

However,

the report didn't break out this split by region. So I decided to

estimate it myself based on the regional split of FWA subscribers, which

was shown in a graphic. I also extended the forecasts out to 2030.

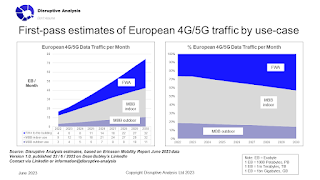

I

then added an additional segmentation of my own - an indoor vs outdoor

split of MBB data. I've pegged this at 75% indoors, aligning with

previous comments from Ericsson and others. Some indoor MBB is served by

dedicated in-building wireless systems, and some is outdoor-to-indoor

from macro RAN or outdoor small cells.

The result is

fascinating. By the 2030, it is possible that over 40% of European 5G

data traffic will be from FWA. Just 14% of cellular data will be for

outdoor mobile broadband. So what's generating the alleged 5G GDP

uplift?

That has massive implications for spectrum policy (eg on #6GHz) and proposed #fairshare traffic fees. It also highlights the broad lack of attention paid to indoor cellular and FWA.

Note:

This is a quick, rough estimate, but it's the type of data we need for

better decisionmaking. I hope to catalyse others to do similar analysis.

A separate second post then looked at the policy aspects of this:

Yesterday's post on mobile data traffic - and contribution from 5G FWA and indoor use - seems to have struck a chord. Some online and offline comments have asked about the policy implications.

No comments:

Post a Comment